What Is Debt Consolidation?

Advertisement

Susan Kelly

Dec 10, 2023

Getting a new loan to pay off existing commitments and consumer debt, including credit card debt, is debt consolidation. It is common to consolidate many debts into a single higher-interest loan with more advantageous repayment conditions, such as a reduced interest rate and monthly payment that is less than the sum of the individual obligations. A debt consolidation loan may be used to cope with student loans, car debt, and other responsibilities.

The Process of Debt Consolidation

It is the action of repaying one or more debts with the aid of other finances. If you have several bills, you may get a loan to pay them all at once. Debit card payments are made until the preceding debt is totally paid off.

Everyone begins by seeking a consolidation loan from either bank, credit union, or card issuer. Excellent payment history with your bank is a beautiful place to start. After being rejected a mortgage, look into private lenders.

Banks and credit unions often issue debit card debt consolidation loans. Creditors do this for several reasons. Debt consolidationincreases collection possibilities.

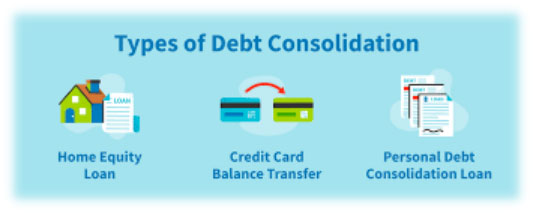

Debt Consolidation Methods

Loans to consolidate debt might be guaranteed or unsecured. Secured loans are those in which the borrower pledges something like a home or vehicle as security to protect the lender. The asset safeguards the loan.

Due to the absence of collateral, securing an unsecured loan may be more difficult. Rising interest rates and lower qualification amounts are typical. Whatever loan you pick, you'll likely pay less interest than a credit card. While interest rates are usually fixed for the whole loan period, exceptions are.

Consolidating your obligations into a cash transaction may be accomplished in various ways. Most common points are listed below:

- Debt consolidation loan:The volume and magnitude of customers' outstanding debts make it difficult for many lenders traditional banks and lenders to issue debt consolidation loans. Consumers looking to pay off several high-interest loans can benefit from using this kind of financing option.

- Credit cards:Consolidating all of your credit card payments onto a single new card is still another option. If the interest rate on this new card is low or non-existent for a defined length of time, it may be a suitable option. A credit card balance transfer option may also be an option, mainly if the card provides a special bonus on the transaction.

- HELOCs:Debt consolidation may also be done via home equity loans or lines of credit (HELOCs).

- Loan programs for college students:The federal government provides various options for those with student debt,including direct consolidation loansunderneath the Federal Direct Loan Program. Private financing is not accepted in this program. The current interest rate is defined as the weighted averages of the previous loans.

Comparison between Debt Consolidation Vs. Debt Settlement

It is important to note that debt consolidation loans do not result in eliminating the original debt. It is more common for lenders to easily switch a customer's loans to a new lender or outstanding debt.It may be advisable to try credit counseling rather than, or even in conjunction with, a debt consolidation loanfor people seeking actual debt relief or all those who don't qualify for loans.

Credit counseling and debt relief groups services are served to those in financial need. Instead of lending money, these groups restructure borrowers' obligations with their creditors. Instead of reducing the number of creditors, debt settlement helps to reduce the number of money owed by a consumer.

For Debt Consolidation, these are the requirements

In the case of a new lender, borrowers must be able to prove their income and creditworthiness. Consolidation loanbills, as well as records from your creditors or repayment agencies, as proof of your job and credit history.

Make a list of your priorities the ones you'll pay first. Your lender may determine this and the order in which creditors are paid. Do so first. A lesser loan that causes extra mental and emotional stress than higher-interest loans (like a personal loan that damaged family ties) may be a better place to start.

Advantages

Many consumers who have numerous high-interest or monthly payments, especially those who owe more, benefit from debt consolidation. Negotiate a few of these loans for a single price instead of many installments and a reduced interest rate.

You might also expect to be debt-free soon if you don't take on any new debt. Consolidating debt may reduce collection calls or letters, providing the new loan is maintained current.

Disadvantages

While a debt consolidation loan'sinterest rate and monthly income may be reduced, following the payment plan is crucial. Longer payment schedules indicate higher overall costs. Ask your credit card issuers how long it takes to pay off your existing commitments at their current interest rates if you're thinking about debt consolidation.

Advertisement